Balance Sheet: Meaning, Format, Formula & Types of Company Balance Sheets

These funds are then invested in assets which helps the business in generating revenue. Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw. Unfortunately, he’s addicted to collecting extremely rare 18th century guides to bookkeeping. Until he can get his bibliophilia under control, his equity will continue to suffer.

Business

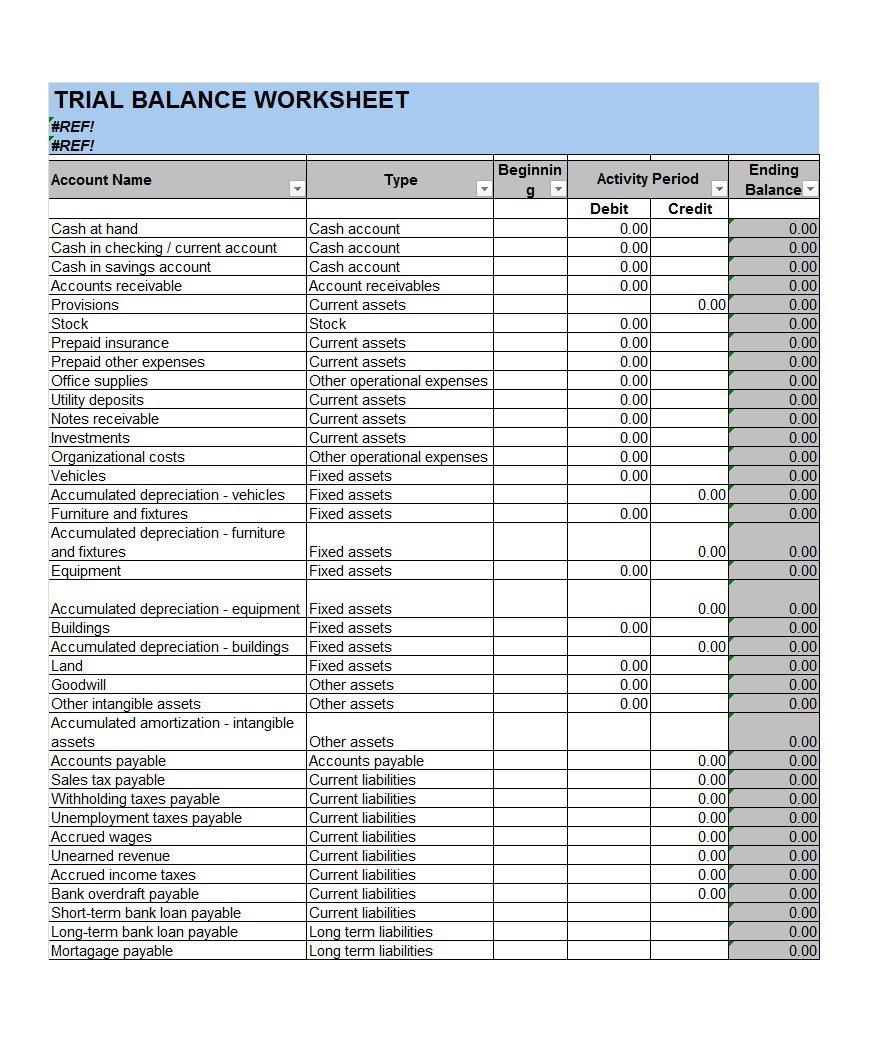

However, a weak balance sheet, high debt levels, or deteriorating financial ratios may raise concerns and affect borrowing costs. Creditors can use the Statement of Financial Position information to make informed decisions about lending terms and interest rates. Here is an example of a basic balance sheet format most commonly used to track the company’s performance for a financial year. Department heads can also use a balance sheet to understand the financial health of the company. Looking at the balance sheet and its components helps them keep track of important payments and how much cash is available on hand to pay these vendors. Do you want to learn more about what’s behind the numbers on financial statements?

- The balance sheet previews the total assets, liabilities, and shareholders’ equity of a company on a specific date, referred to as the reporting date.

- Using financial ratios in analyzing a balance sheet, like the debt-to-equity ratio, can produce a good sense of the financial condition of the company and its operational efficiency.

- It has its shortcomings such as delay, inflation, seasonal variations and incomparability with respect to non-monetary elements, but the benefits clearly exceed the drawbacks.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Current liabilities refer to debts or financial obligations that must be settled within a year.

Understanding Balance Sheet

The statement shows a snapshot of the assets, liabilities and equity of the business at a specific point in time, usually at the end of an accounting period. When we look at a balance sheet, we get a snapshot of a company’s financial health and stability. It tells us about the assets the company owns, the debts it owes, and the equity it has. By analysing these components, we can gauge how well the company is doing financially. The balance sheet records the company’s financial position at a specific moment.

Understanding a Balance Sheet (With Examples and Video)

They can also enable better resource allocation, guiding businesses in deciding where to invest for maximum return. To analyze a balance sheet, you can look at several key ratios and metrics. These ratios include the debt-to-equity ratio, current ratio, and return on equity. These ratios can help you understand a company’s financial health and its ability to meet its financial obligations. The balance sheet can also provide insights into a company’s liquidity, or its ability to meet its short-term obligations.

Noncurrent Liabilities

Assets are resources that a company owns or controls, such as cash, inventory, property, and equipment. Liabilities are obligations that a company owes to others, such as loans, accounts payable, and taxes. Equity represents the residual value of a company’s assets after its liabilities have been paid off. This equation is the foundation of the balance sheet, which is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. The balance sheet equation must always be in balance, meaning that the total value of a company’s assets must equal the total value of its liabilities and equity. Assets are everything that a business owns and can use to pay its debts.

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). A comparative balance sheet enables businesses to compare their financials for multiple periods of time. This comparison enables entrepreneurs, investors and analysts to track revenue trends over time to evaluate if the company is growing, stagnating or failing. By comparing key metrics (assets, liabilities, shareholders’ equity) stakeholders can determine strategies with regard to how the company’s financial health has evolved.

It also yields information on how well a company can meet its obligations and how these obligations are leveraged. This will make it easier for analysts to comprehend exactly what your assets are and where they came from. Often, the reporting date will be the final day of the reporting period. Companies that report annually, like Tesla, often use December 31st as their reporting date, though they can choose any date.

For example, the assets, particular the long term assets are normally shown at cost or revaluation at a point in time, they do not show the current market value of those assets. As an example, the Annual Report for Apple below shows a typical basic statement of financial position format for a listed are campaign contributions tax deductible company. The balance sheet does not form part of double entry it is simply a list of balances at a specific date arranged as as assets, liabilities or equity. Similarly, putting a specific value on intangible assets like brand value or intellectual property can be subjective and tough to determine.

This category is usually called “owner’s equity” for sole proprietorships and “stockholders’ equity” or “shareholders’ equity” for corporations. It shows what belongs to the business owners and the book value of their investments (like common stock, preferred stock, or bonds). The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement. Changes in accounting policies or standards over time can affect how financial data is reported on the balance sheet. For instance, when a company switches from one method of calculating depreciation to another, it affects the reported values for fixed assets. This in turn makes it difficult to compare the balance sheets over the same period in a standardized fashion.

A regular balance sheet provides a snapshot of a company’s financial position at a specific point in time, focusing on a single accounting period, including details like assets, liabilities, and equity. In contrast, a comparative balance sheet compares financial data across multiple periods, typically two or more, allowing businesses to analyze how their financial position has changed over time. A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. The purpose of a balance sheet is to show what a company owns (assets), what it owes (liabilities), and what is left over for the owners (equity). It is a key tool for assessing a company’s financial health and its ability to meet its financial obligations.