Direct Labor Cost: Definition, Calculation, And Expert Tips

Additionally, a detailed breakdown of employee compensation costs, including wages, salaries, and benefits across various industries and occupations, is provided by MployerAdvisor. The cost of labor is the sum of each employee’s gross wages, in addition to all other expenses paid per employee. Other expenses include payroll taxes, benefits, insurance, paid time off, meals, and equipment or supplies. The labor cost formula takes into account an employee’s hourly wages, the hours they work in a week, and the weeks they work in a year.

Hourly Rate Calculation – direct labor cost formula:

Hitech manufacturing company is highly labor intensive and uses standard costing system. The standard time to manufacture a product at Hitech is 2.5 direct labor hours. First, calculate the direct labor hourly rate that factors in the fringe benefits, hourly pay rate, and employee payroll taxes.

How much does labor cost?

- Knowing the true cost of an employee is one thing, but if you’re not including the cost of overhead in your equation, you could be under-billing your clients and losing money!

- This way, you won’t get hit with large expenses at the end of the year.

- Calculating labor costs offers a realistic view of each employee’s financial impact, aiding informed decision-making and the development of strategies to control or reduce expenses.

- Labor productivity can be measured at the level of an individual worker, a team, a department, a company, an industry, or even an economy.

Monitoring and analyzing changes in your effective labor rate over time allows you to identify trends and make informed decisions about staffing levels and productivity. If your effective labor rate increases steadily, it could indicate that you are either becoming more efficient or charging higher rates due to increased demand for your services. One way to improve your effective labor rate is by increasing productivity without compromising quality. This could mean streamlining processes, implementing technology solutions, or providing additional training to enhance skills and expertise within your team.

Labor cost calculators save you time

When you determine your labor cost percentage, you can make a deeper analysis of your employee expenses. That’s how you can figure out if you need to reduce them to increase your overall profit margins. After downloading our labor cost calculator, simply put your data into the appropriate calculation boxes.

Step 4 Determine The Total Annual Labor Cost

GAAP rules provide that companies may use direct labor as a cost driver to allocate overhead expenses to the production process. Overhead costs refer to indirect costs that cannot be connected to a specific final product. However, such costs are required in the production process of goods and must, therefore, be added to the overall cost of the product. Salaried employee costs are easy to calculate since they have a fixed annual salary and aren’t typically eligible for overtime pay.

It’s no wonder, then, that understanding and calculating this financial variable is a big part of whether or not your business runs smoothly. Oyster’s automated solutions give you detailed insights into every aspect of labor expenses, allowing you to manage your workforce expenses with precision. Learn more about Oyster’s what is the purpose of an irs w EOR services to find out how it can transform your talent strategy. How much a company pays for employee health insurance depends on the size of the company. As mandated by the Affordable Care Act (ACA), companies with more than 50 full-time employees must offer a company health plan or pay a tax penalty.

After salaries, benefits and perks are usually your second largest employee expense. These include things like health insurance premiums, retirement, and paid time off. To begin your labor cost assessment, clearly segment employees based on role and salary. Accurately tracking and managing billable hours can significantly impact this metric. Remember that only productive work should be included when calculating hours sold or billed; non-billable tasks like administrative work or breaks shouldn’t be factored in. FLSA also requires you to keep track of your employees’ hours and maintain valid and accurate records.

Even if some of them are not visible to the employees, they are still costs that the company has to consider when calculating an employee’s labor cost. In this article, we’ll explore the labor cost definition, how to calculate labor cost, and how to reduce labor costs. Another strategy is to outsource jobs to different states or countries that are more cost effective. But keep that approach balanced — don’t forgo an excellent hire just because they require a higher state unemployment tax contribution, for example.

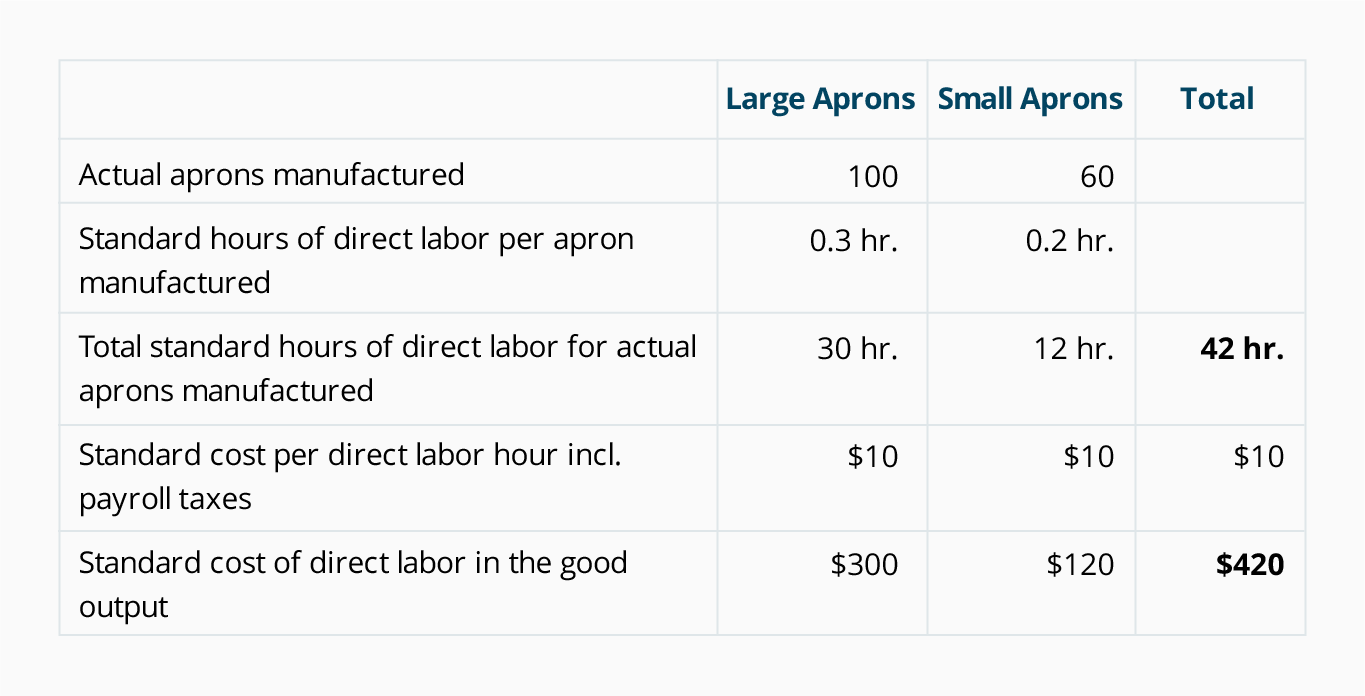

The other two variances that are generally computed for direct labor cost are the direct labor efficiency variance and direct labor yield variance. In essence, then, this number is your annual direct labor cost — it’s how much you’re actually paying out for your employee to produce widgets every year. Direct labor refers to the salaries and wages paid to workers directly involved in the manufacture of a specific product or in performing a service.

We’ve done all the work for you so you can get a functional template in seconds, not hours. An example is when a highly paid worker performs a low-level task, which influences labor efficiency variance. Labor costs are one of the highest expenses that most businesses contend with. Once you’ve identified your cost and how it applies to your rate of production, you can tweak any number of variables and procedures within your business to achieve the result you’re after. That number tells you that when you’ve factored in all the other employee expenses, you’re paying your employee $22.80 per hour to produce widgets.